Your Trusted Partner for Cryptocurrency

Accounting and Tax Preparation

WHAT WE DO

Personalized Crypto Tax

Solutions for Individual Investors

Simplify Your Crypto Taxes: Effortless Preparation at Your Fingertips

Cryptocurrency Taxation

Our cryptocurrency tax services streamline account reconciliation and tax report preparation. Our expert accountants ensure precise tracking and reporting of your crypto transactions, minimizing errors and ensuring compliance. We provide:

- Comprehensive account reconciliation

- Detailed cryptocurrency tax reports

- Guidance on complex crypto tax scenarios (e.g., DeFi, NFTs, mining)

- Assistance with historical transaction analysis

Tax Return Preparation

Our firm specializes in comprehensive individual tax preparation, with a focus on accurately reporting cryptocurrency transactions. We assist clients in preparing and filing individual tax returns, ensuring:

- Accurate reporting of cryptocurrency transactions

- Compliance with tax authorities and state tax guidelines for all tax items

- Maximization of deductions and credits

- Timely submission to avoid penalties

Strategic Tax Planning

We specialize in unraveling intricate tax issues with precision and foresight. Our proactive tax planning services would include:

- Minimize tax liability on crypto investments

- Optimize tax benefits across all financial areas

- Develop long-term strategies for wealth accumulation

- Advise on tax-efficient crypto trading and investment strategies

The Experts in Crypto Taxation and Accounting

Bitcounts is your trusted source for expert crypto tax preparation and crypto accounting for web3 companies.

Our qualified cryptocurrency accountants assists clients in accounting for all types of crypto transactions. We bring solid experience & talent in handling areas such as ICO, NFT minting, Rebase, Staking, Swaps, Mining, DeFi, Lending, Margin, Derivatives trading, etc.

WE OFFER

Streamlined Crypto Bookkeeping

Services for Businesses

Accurate Crypto Reporting: Focus on Your Business, Not Your Books

Cryptocurrency Accounting

We provide specialized accounting services for crypto businesses, including:

- Reconciliation and classification of cryptocurrency transactions

- Crypto-specific journal entries and ledger management

- Preparation of financial reports compliant with GAAP/IFRS

- Integration of crypto accounting with traditional financial systems

Business Tax Return Preparation

We assist in preparing and filing business tax returns, ensuring:

- Accurate reporting of all business activities, including crypto transactions

- Compliance with evolving cryptocurrency tax regulations

- Maximization of business deductions and credits

- Timely filing to avoid penalties

Web3 Startup Consulting

Our crypto accountants offer comprehensive tax consulting for Web3 startups, including:

- Structuring advice for tax efficiency

- Guidance on token offerings and cryptocurrency payments

- International tax planning for decentralized operations

- Compliance strategies for emerging Web3 business models

Blockchain Business Bookkeeping

We offer tailored bookkeeping services for blockchain businesses, covering:

- Integration of cryptocurrency and traditional transaction entries

- Real-time tracking of crypto assets and liabilities

- Preparation of crypto-inclusive financial statements

- Assistance with crypto payment reconciliation and reporting

Our Process

Bitcounts is pioneering innovation in the accounting industry by specializing in the emerging cryptocurrency sector. We offer comprehensive expertise and a full spectrum of services, ensuring every aspect of your crypto investment business is optimized and aligned.

- Book a call or email us your scenario. Fill up this form to get started.

- We’ll reach out to guide you through the next steps.

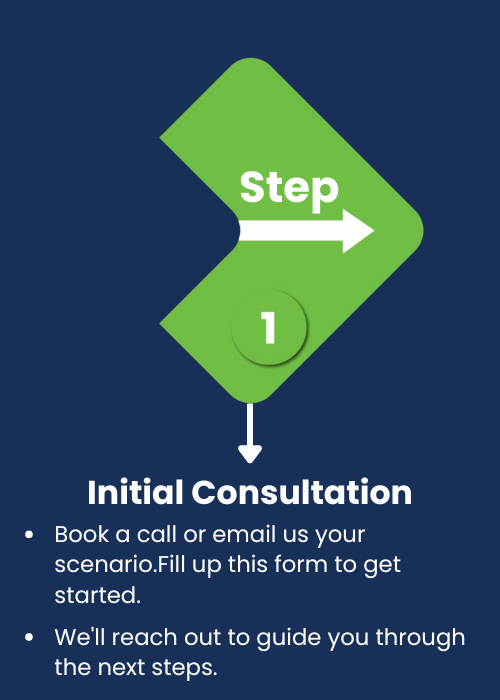

Step 1 –

Initial Consultation

- Book a call or email us your scenario. Fill up this form to get started.

- We’ll reach out to guide you through the next steps.

Step 2 –

Data Analysis

- Our team thoroughly examines your provided information about your wallet and CEX.

- We’ll present a detailed quote and estimated timeline for the completion of the project.

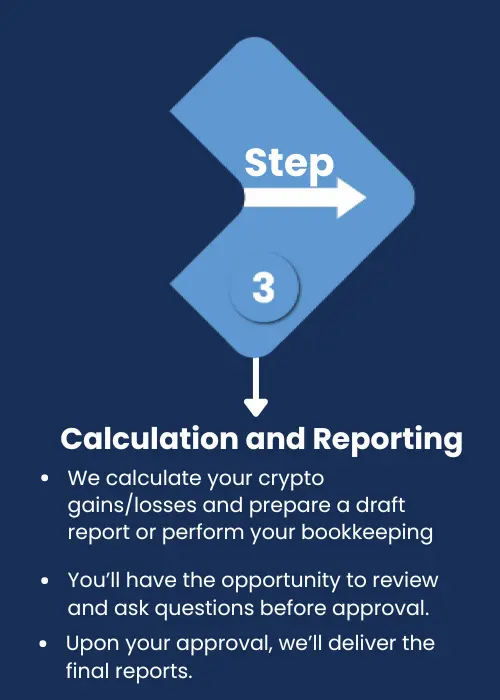

Step 3 –

Calculation and Reporting

- We calculate your crypto gains/losses and prepare a draft report or perform your bookkeeping

- You’ll have the opportunity to review and ask questions before approval.

- Upon your approval, we’ll deliver the final reports.

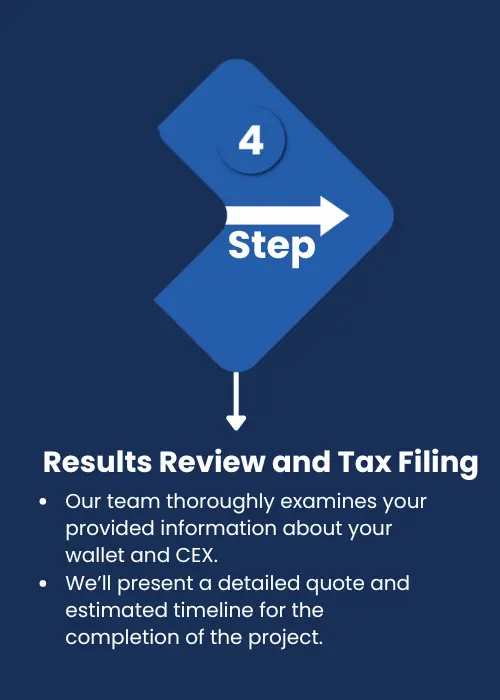

Step 4 –

Results Review and Tax Filing

- Our team thoroughly examines your provided information about your wallet and CEX.

- We’ll present a detailed quote and estimated timeline for the completion of the project.

Precise Crypto Tax Accounting: Maximize Accuracy, Minimize Liability

Expert Calculation and Strategic Planning

Whether you’re filing independently or working with a CPA, our service ensures comprehensive and accurate cryptocurrency tax reporting. We meticulously analyze your data to identify missing transactions and calculate precise profits and losses, empowering you to file your tax return with confidence.

Personalized, Hands-On Approach

Our team works directly with you to process your crypto exchange CSV files or API data. We expertly merge, aggregate, and consolidate all transactions, applying accurate currency exchange rates to determine your true financial position. Our service covers both current and retroactive calculations for multiple years.

Transparency and Education

Receive a detailed crypto tax report that clearly outlines your profits and losses. Our interactive process goes beyond mere numbers—we ensure you fully understand your results and are available to answer all your questions. This collaborative approach provides valuable insights into your cryptocurrency journey and helps refine your trading strategy.

Peace of Mind Guaranteed

We’re committed to your satisfaction. Our thorough, personalized service gives you the assurance that your crypto taxes are handled correctly, allowing you to focus on your financial goals with confidence.

Bitcounts: Pioneering

Crypto Compliance

Solutions

Bitcounts Inc. is a global leader in cryptocurrency accounting, seamlessly blending cutting-edge technology with personalized service. Our extensive experience across diverse accounting sectors has enabled us to excel in the dynamic cryptosphere, delivering unparalleled value to a wide range of clients: Individual investors, Large family offices, VCs, Crypto traders and miners, NFT developers, Crypto gaming platforms, ICO promoters, Web3 companies.

Our Commitment:

- Effective Communication: Clear, timely, and transparent interactions

- Quality Service: Leveraging expertise and advanced tools for precise results

- Client Satisfaction: Tailored solutions that exceed expectations

Contact our Web3 accounting firm today to get your crypto accounting and tax reporting done right. Your compliant Crypto Reporting is just a message away!