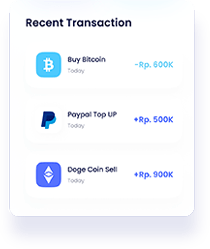

Cryptocurrency DeFi NFT Token

Accounting Firm and Tax Consultants

Cryptocurrency Accounting Firm to Take Care of

Your Crypto Bookkeeping and Taxes

Bitcoin(BTC)$45,173.973.86%

Ethereum(ETH)$2,434.611.07%

Tether(USDT)$1.000.13%

Binance Coin(BNB)$317.443.71%

XRP(XRP)$0.511.17%

USDC(USDC)$1.000.08%

Litecoin(LTC)$68.950.89%

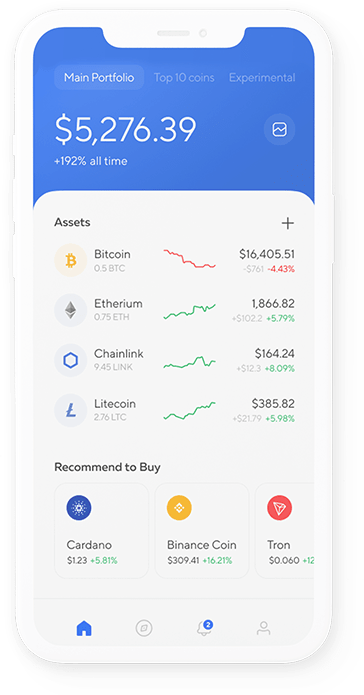

Create your crypto tax report today

Bitcounts Inc. is a multinational crypto accounting firm with deep expertise in cryptocurrency taxation and blockchain accounting having offices in the United States, Canada, Australia, India and the United Kingdom.

Being a cutting-edge tax and accounting firm, we provide a full range of traditional tax and accounting services. We are one of the few accounting firms currently in the market with deep expertise in cryptocurrency taxation and blockchain accounting.

Get started

in a few

minutes with us

Step 1 –

Get in touch with us

- You can go on Get in touch page and fill the form to tell us about your crypto scenario.

- We will contact you within few minutes to get started.

Step 2 –

Examination of your data

- We’ll examine your data

- Provide you a quote and expected time to complete your reports.

Step 3 –

Calculation and Reporting

- We will calculate your crypto gains/losses and provide you with the Crypto Tax Report.

Step 4 –

Meeting to discuss your report

- We’ll setup a meeting to go over your results.

- We can also work with your CPA to file your taxes.

- If you want us to file, you can let us know.

Our

Cryptocurrency Accountants

work with all types of Crypto

Bitcounts Inc. is leading a revolution in accounting industry by providing services in the less explored Crypto space. We bring deep experience and range of services under one roof, and can help ensure that all moving parts of your Crypto Investments business are aligned.

We are passionate about helping clients make sense of their unique tax situations and understand the tax implications of their personal and business decisions. We provide top-notch tax planning solutions to help our clients choose the most advantageous business structure for their startup business. We act as our client’s trusted advisors to help them take care of their business, tax, and accounting needs.

We serve all types of clients, with a strong focus on individuals and small businesses. We provide services across the United States and globally.

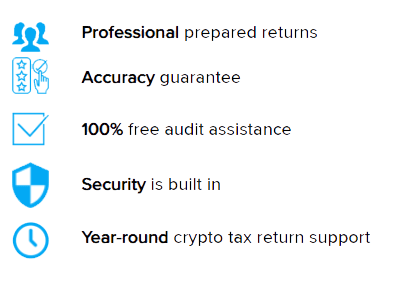

The most trusted

cryptocurrency

tax firm

Cryptocurrency Accounting Firm to Take Care of Your Crypto Bookkeeping and Taxes.

Top Muti-national Crypto Tax Accounting Firm

in the USA, Canada, Australia, India and UK

Sofia Jones

Jay

Crane

Bobby

Sarah

Peter

You can learn more

about our

Services

As a passive investor we can assist you in understanding and calculating your cryptocurrency capital gains tax obligations and work with you to take advantage of tax minimisation strategies, allowing you to plan appropriately for the future so you can to continue to grow your wealth.

If you are regularly trading in spot/futures markets or flipping tokens on decentralised exchanges, you may be deemed a trader for tax purposes and will be subject to slightly different tax rules. Our crypto accountants assess your activities to ensure their income is classified and calculated correctly.

Businesses operating in the crypto and blockchain space or accepting cryptocurrency as payments are often misunderstood by traditional accountants. We offer a full suite of bookkeeping, accounting and management reporting services work, ensuring businesses are meeting their reporting and compliance obligations.

We assist DeFi participants who are borrowing and lending on decentralised money markets navigate the complex DeFi tax implications that can arise when transacting on these protocols.

DeFi protocols have given rise to unprecedented opportunity to generate yields that far exceed what is possible in traditional finance. Complex yield farming strategies are not only stressful to manage but can be a nightmare when it comes to record keeping. We assist yield farmers in maintaining appropriate records and determining their crypto tax obligations in the USA.

The US crypto tax implications of staking your crypto to a network or protocol can be complex and confusing. We assess our client’s staking activities to help them understand their tax obligations.

Airdrops are commonly used by new protocols to incentivise users to use their product and the tax treatment of these airdrops are commonly misunderstood. As crypto accountants, we understand the crypto tax obligations that arise as a result of receiving airdrops.

DAOs are a novel way to organise both financial and human capital with some of the largest existing DAOs controlling treasuries worth billions of dollars. We provide financial accounting and management reporting services to DAOs, enabling them to maintain proper financial records of their treasuries and operating activities. Accurate financial statements are critical in providing token holders and other stakeholders with confidence in a DAOs financial management and necessary to appease potential investors.

Decentralised games and virtual worlds have given rise to innovative play-to-earn models and unique methods for gamers to earn an income. We work with gamers to assess whether their activities are taxable and how to calculate their cryptocurrency taxable income.

NFTs and digital collectibles are assets that are commonly overlooked by investors but may still be taxable depending on the circumstances in which they were acquired. We assist our clients in determining the NFT tax implications of these unique crypto investments.

There has been an explosion in virtual real estate transactions in recent times as the Metaverse gathers momentum and innovative companies establish virtual headquarters. We assist our clients in understanding the crypto tax implications of buying, selling and renting virtual property.

Whether you’re mining your favourite token or have established a complex multi-rig Bitcoin mining operation, we assist our clients in assessing their taxable revenue, allowable deductions, eligibility to access certain tax concessions and how to appropriately assess depreciation on the hardware used in their operations.

Innovations in proof-of-stake have significantly reduced the capital intensity of validating blockchains, allowing more users to participate in securing these networks. Decentralised oracle networks also serve as key infrastructure in securing data transmission and allow smart contracts to execute effectively. We assist node operators in assessing their taxable revenue, allowable deductions, eligibility to access certain tax concessions and how to appropriately assess depreciation on the hardware used in their operations.

Auditing the activities of businesses and crypto self-managed super funds that have been participating in the crypto ecosystem can be difficult, especially if you have a limited understanding of how these networks operate. As a global crypto tax professionals, we work with auditors to assist them to understand and verify the activities of their clients.

Crypto is a niche that many professionals struggle to advise effectively on as their knowledge and understanding of how these networks operate is limited. As specialist crypto accountants, we provide bespoke services to other professional firms, enabling them to appropriately service their own clients active in the crypto ecosystem.

Our Favorite Tools